All Categories

Featured

Take Into Consideration Utilizing the cent formula: penny stands for Financial obligation, Revenue, Mortgage, and Education. Overall your financial debts, home mortgage, and university expenditures, plus your wage for the variety of years your household requires protection (e.g., up until the youngsters run out the residence), which's your coverage need. Some financial professionals compute the amount you need making use of the Human Life Worth approach, which is your life time earnings prospective what you're earning now, and what you anticipate to gain in the future.

One way to do that is to seek firms with solid Economic stamina ratings. best term life insurance for college students. 8A business that finances its own plans: Some companies can market policies from one more insurance firm, and this can include an additional layer if you intend to alter your plan or later on when your household requires a payment

Level Term Or Decreasing Life Insurance

Some companies use this on a year-to-year basis and while you can expect your prices to climb significantly, it may deserve it for your survivors. One more method to contrast insurance business is by looking at online consumer testimonials. While these aren't most likely to inform you a lot about a firm's financial security, it can tell you exactly how easy they are to work with, and whether claims servicing is an issue.

When you're more youthful, term life insurance policy can be an easy way to protect your enjoyed ones. As life changes your economic concerns can also, so you may want to have whole life insurance policy for its lifetime coverage and additional benefits that you can use while you're living. That's where a term conversion is available in - how long, typically, is the grace period on a $500,000 level term life insurance policy?.

Approval is ensured regardless of your health and wellness. The costs will not increase once they're set, however they will rise with age, so it's a great concept to secure them in early. Learn more concerning how a term conversion functions.

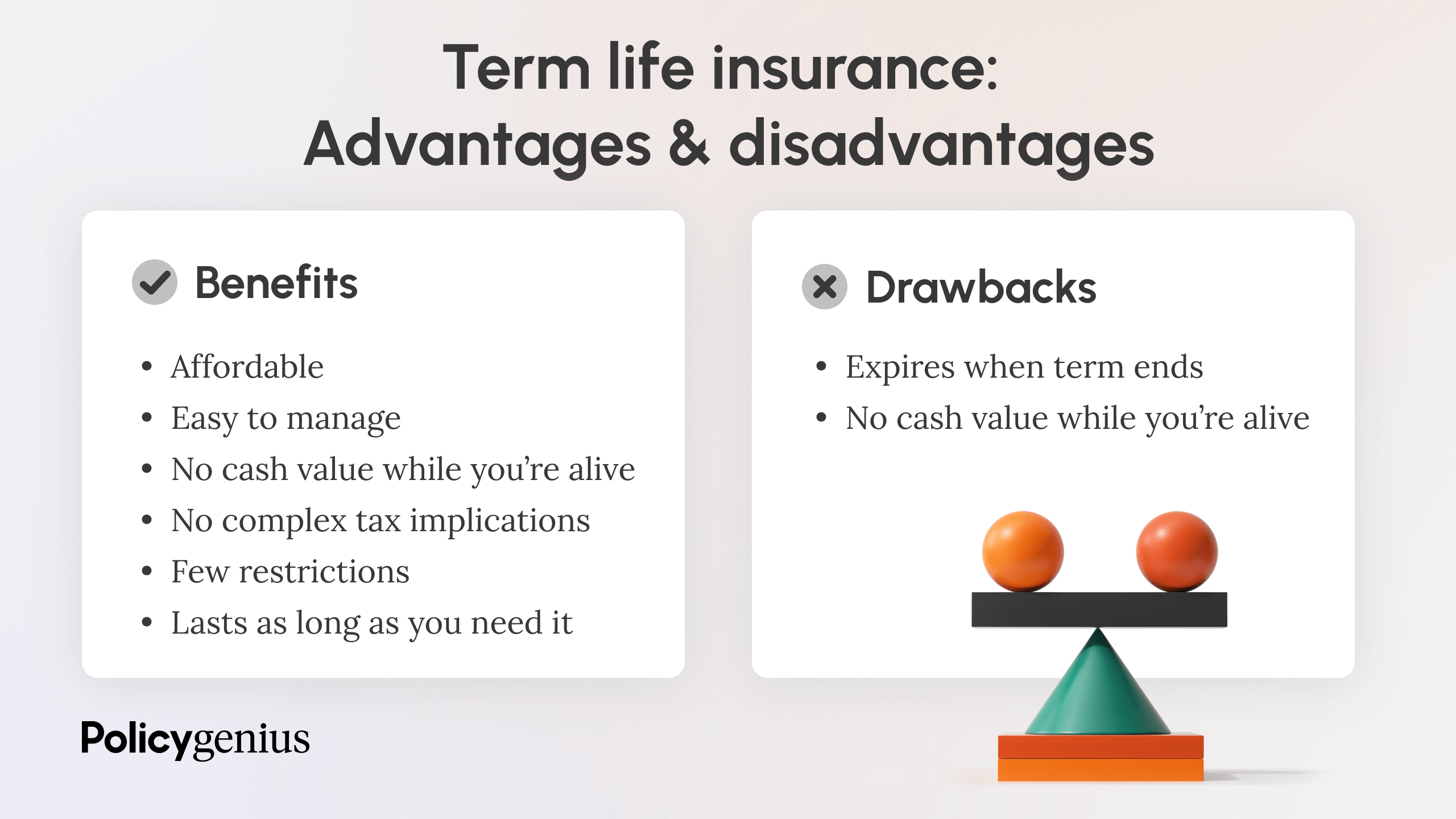

1Term life insurance policy offers temporary protection for an essential duration of time and is generally more economical than long-term life insurance coverage. taxable group term life insurance. 2Term conversion standards and constraints, such as timing, might use; for instance, there might be a ten-year conversion opportunity for some items and a five-year conversion privilege for others

3Rider Insured's Paid-Up Insurance Purchase Alternative in New York City. 4Not readily available in every state. There is a cost to exercise this biker. Products and motorcyclists are readily available in accepted territories and names and attributes may vary. 5Dividends are not assured. Not all taking part policy owners are eligible for rewards. For choose riders, the condition applies to the insured.

Latest Posts

A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Ad&d Insurance Vs Term Life Insurance

Accidental Death Insurance Vs Term Life